Bitcoin markets tumbled during the early hours of October 18 dropping roughly 6-7 percent to a low of $5,101 per token. Bullish optimism seemed to be stepping off to the sideline today as the decentralized currency struggled to capture the $5,640 zone again.

Bitcoin Markets See Some Short-Term Sell-Off

Bitcoin markets had a bit of sell-off today, as the currency has dropped from yesterday’s high of $5,640 to a low of $5,101 per BTC. At press time the value has rebounded as the price per bitcoin is hovering slightly above the $5,600 range, with around $2.3B in 24-hour global trade volume. At the moment, buyers seem to be waiting for better positions as the sell-off might not last, and the uptrend may pick up again in the short term.

Surpassing the $6K range is still the ‘talk of the town’ among traders, and even though two forks are approaching, these traders are still optimistic. Today, bitcoin markets might stick around its current territory and consolidate between the $5,580-$5,650 zone; unless further support breaks down when Japanese markets open.

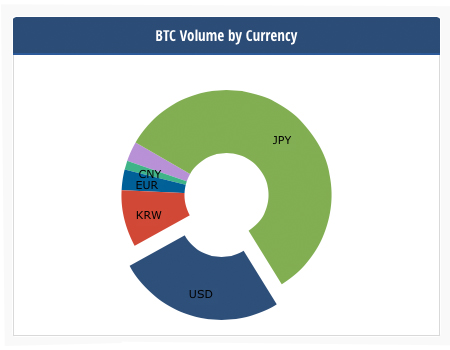

Japan is still dominating the world’s trade volume at 57 percent with the U.S. trailing slightly behind. South Korean bitcoin markets are still red hot as this region is currently capturing the third highest BTC trade volume. This week’s top five exchanges by volume are Bitfinex, Bithumb, Bitflyer, Hitbtc, and Bitstamp. The top five exchanges command over $652M worth of bitcoin trade volumes, or 121908 BTC swapped over the past 24-hours. The price has broken key levels of support below the $5,150 range earlier today, but we are looking to see if it drops below the $5,100 zone which could lead a more substantial sell-off.

Technical Indicators

Technical indicators show the 100 Simple Moving Average (SMA) has crossed paths with the 200 SMA and is sinking below the longer term trendline. This means the path to the upside might take longer to achieve and further dips could be in the cards. Both the Stochastic and Relative Strength Index (RSI) are also heading south as the oscillators show overbought conditions and likely a touch more correction.

Fibonacci retracement levels indicate this particular dip could follow to price ranges between $5,450-5,600. As we stated in our last markets update, we are watching to see if the Displaced Moving Average (DMA) support breaks $5,100. If this happens, markets could break support below the sub-$5K zone following the typical 30 percent pullback pattern that takes place every few weeks.

The Top Five Digital Asset Market Overview

In general cryptocurrency markets, the top five digital assets are also seeing price dips today between 5-12 percent. Ethereum (ETH) markets had dropped 8 percent in value today after a quick pump before its 5th fork. The price per ETH is now $315, while the third highest market ripple (XRP) is down 11 percent at $0.21 per XRP. Bitcoin cash (BCC) markets had seen a significant uptrend in value yesterday on October 17, reaching close to $400 per BCC.

The price per BCC at the time of writing is $345 after markets dipped 11 percent. Lastly, litecoin (LTC) is still holding the fifth highest market cap at $60 per LTC but has seen prices slashed by 9 percent this morning. The entire cryptocurrency market capitalization of all the digital assets combined is still a whopping $169B.

The Verdict

Bitcoin markets are commanding an $87B market cap, and BTC dominance compared to other digital asset shares is 54 percent right now. Again traders still seem confident that bitcoin markets could reach new highs before the upcoming forks. Many individuals believe money from alternative digital currencies will be sold for bitcoin to get in on the possible split(s).

However, this means cheaper altcoins may get some buyers as some of these tokens haven’t seen lows like this in months. The trade-offs between altcoins and bitcoin before the fork may be a zero-sum game. Probably the most prominent thing people in crypto-land are thinking about right now is their upcoming plans for the possibility of a chain split. At this vantage point from now until the fork(s), prices could easily vary between $4800-$6K+ with extreme price swings going both ways.

Bear Scenario: Sellers have control at the moment as buyers have definitely stepped away from overbought conditions. There are strong floors between the $4,800-5,100 zone for the short term, as buyers are waiting in this area in great number. If the bearish sentiment continues prices below $5K could very well be in the playbooks, which would likely lead to some panic selling for a short period. If DMA support breaks $4800, the averages of around $4,400-4,600 could very well happen too.

Bull Scenario: As stated above bitcoin markets have followed a consistent cycle of 30 percent corrections followed by an upside trend pushing its value to new all-time-highs (ATH). This bearish period right now may not lead to a substantial correction, but it could be the start. When the bottom is found, it’s likely bulls will take the lead again and prices could reach $5,800-5,900 soon. Further, there are expectations from some traders who envision the price wave spiking to $6K or $6,500 during the pre-fork(s) period. Bulls have a lot of work to do to obtain these levels again, and for now, it’s going to take a bit longer.

Disclaimer: Bitcoin price articles and markets updates are intended for informational purposes only and should not to be considered as trading advice. Neither Bitcoin.com nor the author is responsible for any losses or gains, as the ultimate decision to conduct a trade is made by the reader. Always remember that only those in possession of the private keys are in control of the “money.”

No comments